3D printing, also known as additive manufacturing, is no longer just an experimental technology. Today, it is transforming how industries design, produce, and deliver products. From aerospace and healthcare to consumer goods and automotive, the impact of this innovation is reshaping global supply chains. Investors are now eyeing 3D printing stocks as a gateway to participate in this shift toward smarter, faster, and more sustainable manufacturing.

In this article, we will explore how 3D printing stocks are driving industrial disruption, which companies are leading the sector, and why this market is becoming a long-term opportunity for forward-thinking investors.

The Rise of 3D Printing in Manufacturing

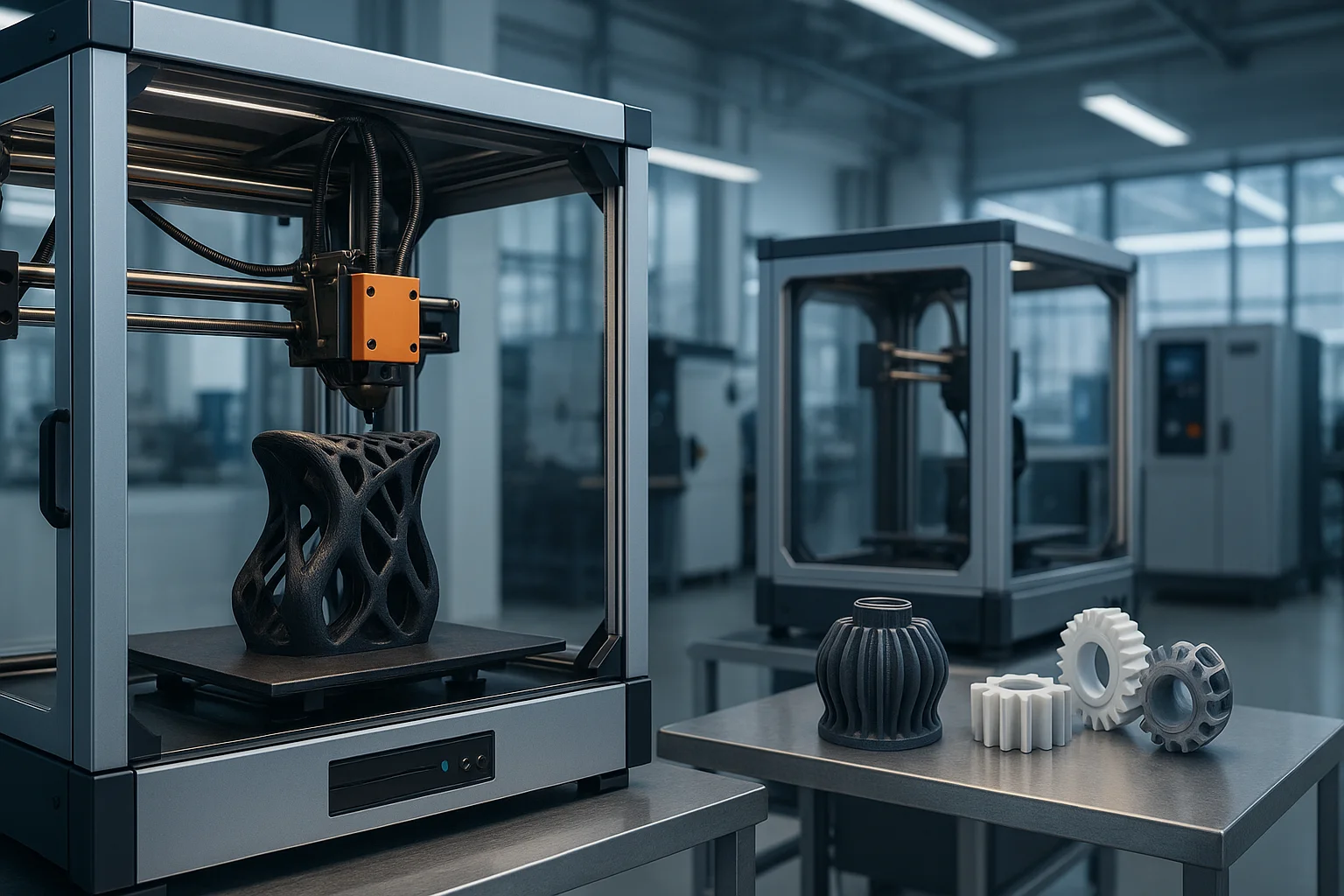

Although the origins of 3D printing date back to the 1980s, the last decade has seen remarkable progress. Unlike traditional manufacturing methods, which cut away material, additive manufacturing builds objects layer by layer from digital blueprints. This not only reduces waste but also allows for complex designs and customized solutions.

Falling costs, improved printer performance, and growing demand for sustainability have pushed adoption across multiple industries. Today, 3D printing is more than a prototyping tool—it is becoming an integral part of full-scale production.

Why Investors Are Focusing on 3D Printing Stocks

3D printing is moving into the mainstream, and companies developing this technology are gaining investor attention. Global manufacturers, research institutions, and even governments are integrating additive manufacturing into their strategies.

Investors are drawn to 3D printing stocks because:

- They represent direct exposure to a disruptive technology.

- Adoption is spreading across critical industries like aerospace, healthcare, and automotive.

- Long-term growth prospects are supported by increasing research and development (R&D) investment.

This combination of technological innovation and market demand makes 3D printing a strong candidate for portfolio diversification.

Key Drivers of 3D Printing Adoption

Customization and Design Freedom

3D printing makes it possible to create highly complex geometries and customized products that traditional methods cannot achieve. This is particularly valuable in aerospace components, dental prosthetics, and medical implants.

Faster Prototyping and Market Entry

Rapid prototyping allows companies to design, test, and launch products more quickly. Industries like consumer electronics and automotive benefit from shorter development cycles and reduced time-to-market.

Sustainability and Reduced Waste

Sustainability is one of the strongest selling points for additive manufacturing. With minimal waste, recyclable materials, and reduced transportation needs, 3D printing helps companies lower their carbon footprint.

Cost Efficiency in Small Batches

For low-volume production, 3D printing can be more cost-effective than traditional manufacturing. Startups and small businesses, in particular, can benefit from this scalability.

Industries Being Disrupted by 3D Printing

Aerospace and Defense

The aerospace industry is using 3D printing to create lighter, stronger parts that improve fuel efficiency and reduce maintenance costs. Companies like Boeing and Lockheed Martin are already embedding additive manufacturing into their production lines.

Healthcare and Medical Devices

From patient-specific prosthetics to bioprinted tissues, 3D printing is revolutionizing healthcare. Dentists, surgeons, and medical device companies are now using additive technology for personalized solutions.

Automotive

Major automakers, including Ford and BMW, use 3D printing to prototype and even manufacture end-use components. Faster design validation means a competitive edge in the auto industry.

Industrial Manufacturing

Factories are producing tooling, jigs, and fixtures faster with 3D printing. This flexibility helps manufacturers stay lean and respond quickly to shifting market demands.

Consumer Products

Brands in footwear, eyewear, and electronics are leveraging customization at scale. Companies like Adidas have already used 3D printing to develop next-generation shoes tailored to individual consumers.

Leading 3D Printing Stocks to Watch

Stratasys Ltd. (SSYS)

Known for its FDM and PolyJet technologies, Stratasys is a leader in industrial-grade 3D printing with strong partnerships in aerospace, automotive, and healthcare.

3D Systems Corporation (DDD)

A pioneer in the industry, 3D Systems offers comprehensive 3D printing solutions spanning printers, software, and materials for both plastic and metal parts.

Desktop Metal Inc. (DM)

Focused on metal additive manufacturing, Desktop Metal’s binder jetting technology is designed for speed and scalability, making it a key player in industrial adoption.

Proto Labs Inc. (PRLB)

Combining 3D printing with CNC machining and injection molding, Proto Labs delivers fast-turnaround, high-precision manufacturing for multiple industries.

Materialise NV (MTLS)

With a strong focus on software and services, Materialise provides cloud-based solutions and medical applications that set it apart from hardware-only competitors.

Challenges Facing 3D Printing Stocks

Production Speed and Scalability

While additive manufacturing is advancing rapidly, large-scale production remains slower compared to traditional manufacturing. Improving throughput without sacrificing quality is a major hurdle.

Material Limitations

Although the range of printable materials is expanding, challenges remain for applications requiring high durability, heat resistance, or specific certifications.

Regulatory Barriers

Industries such as healthcare and aerospace have strict regulations that can slow down adoption and product approval processes.

Market Volatility

Many 3D printing companies are still in growth phases, making their stock prices sensitive to investor sentiment and broader market fluctuations.

The Future Outlook for 3D Printing Stocks

The global 3D printing market is projected to exceed $60 billion by 2030, driven by expanding industrial applications, improved materials, and faster machines. With governments and corporations investing heavily in research, the long-term outlook is strong.

As additive manufacturing moves deeper into mainstream production, the demand for reliable providers of hardware, software, and materials will increase. This creates long-term opportunities for investors in well-positioned companies.

How to Evaluate 3D Printing Stocks

- Financial Health: Review revenue growth, profit margins, and cash flow.

- R&D Investment: Companies investing in innovation are more likely to sustain leadership.

- Partnerships and Clients: Collaboration with aerospace, healthcare, or automotive giants signals credibility.

- Diversified Business Model: Firms offering hardware, software, and services can better navigate industry shifts.

Final Thoughts

3D printing stocks represent one of the most exciting opportunities in modern manufacturing. By combining sustainability, efficiency, and design flexibility, these companies are challenging traditional production models and paving the way for a new industrial era.

For investors, the sector offers exposure to a disruptive technology with strong growth potential. However, success lies in selecting companies with solid financials, strong partnerships, and ongoing innovation. With the right strategy, 3D printing could become not just a trend but a cornerstone of future manufacturing and long-term investment growth.